Stay connected

Subscribe to our health benefits blog and follow us on social media to receive all our health benefits industry insights.

"*" indicates required fields

Americans list paying for healthcare as their No. 1 financial concern. In fact, they are just as worried about paying for healthcare as they are about their actual health. A full 25 percent of Americans say it’s their biggest worry, up from 15 percent two years ago.

This shift no doubt directly correlates to the dramatic rise of out-of-pocket healthcare costs, as evidenced by growing deductibles and how much employees are now being asked to pay toward their health coverage. In just the past two years the number of employees at companies with more than 200 employees and a deductible over $1,000 went up 40 percent—a figure expected to continue its upward trajectory. The average deductible among covered workers with individual plans is now $1,573.

Skyrocketing health expenses building and evolving the CDHP market

Today’s employee-benefits leaders are actively looking for ways to reduce cost, simplify and facilitate stronger employee engagement. Consumer-directed healthcare plans (CDHPs) support all of these goals and will continue to thrive in this space as long as they remain priorities.

Already, CDHPs have grown by double digits—and are projected to increase in number from 62.6 million in 2017 to 96 million in 2021. As of 2018, 37 percent of covered employees were enrolled in a CDHP.

In particular, employers are becoming more comfortable incorporating health savings account (HSA) offerings into their benefits portfolio. According to Aite, the number of HSAs is projected to grow from 18.6 million in 2017 to 42.6 million in 2021, and HSA payments are expected to skyrocket to $66 million by 2021, from $29.8 million in 2017. The reason we are seeing such a high level of growth in HSA adoption is due to the significant tax benefits associated with these accounts, as well as an increase in understanding by consumers and employers on the long-term savings potential that HSAs present.

Employees want multiple insurance plan options

While deductibles continue to increase and a strong movement toward HSA plans builds across businesses of all sizes, one of the more notable shifts over the last 12-24 months relates to employers providing employees with a choice of insurance plans as opposed to going full replacement.

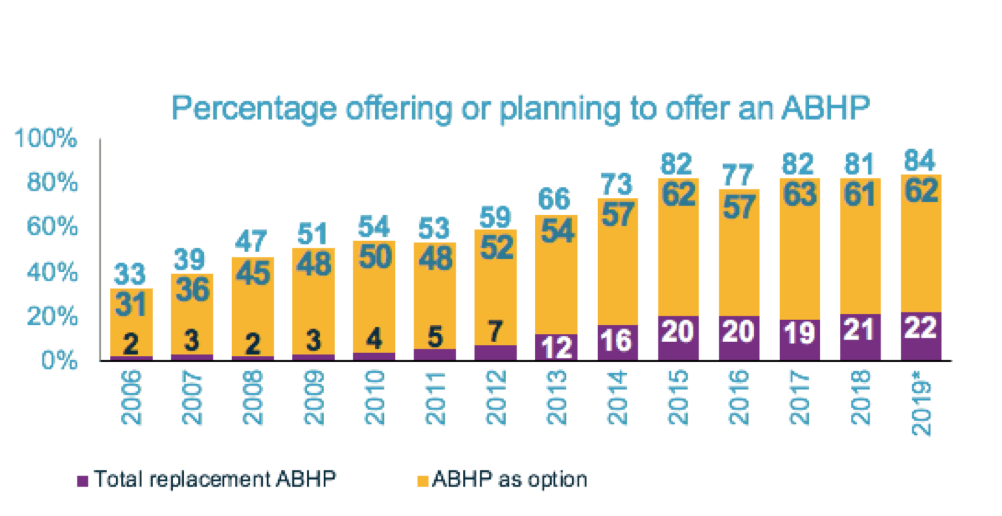

Source: Willis Towers Watson

The yellow bar in the above chart represents companies with account-based plans as an option, and the purple indicates where it’s the only option, i.e. total replacement. Currently, 21 percent of employers offer CDHPs as their only plan. There was a time when a full replacement strategy was a strong trend among employers, and a direction we thought the market was moving in; you can see the growth from 2 percent in 2006 to 20 percent in 2015. What we are seeing now is that growth trend leveling off, as employers think more about providing options to their employees so employees can choose the plan that is right for them.

With multiple insurance plan options comes the need to support multiple accounts—flexible spending accounts (FSAs) and health reimbursement accounts (HRAs) along with HSAs. Over time, employees can be expected to, and do, move between these different accounts, as their healthcare needs and risk tolerances change and plan designs evolve.

As employers move toward offering employees choice, it’s important that they have solution providers who can support a multi-account solution. Employer turnover has been found to be 40 percent lower among WEX Health Partners that offer multiple accounts. And more than 95 percent of our top-quartile growth Partners offer multiple accounts.

We’re proud that we’re able to offer our Partners the WEX Health Cloud, the only platform built from the ground up to handle all benefit account types in a single platform, supporting more of each account type (HSA, FSA and HRA) than any other in the industry. We invest in the growth of our Partners by working strategically with them to capture new market opportunities and define growth strategies. You can count on us to keep the platform flexible to accommodate new growth as the health benefits landscape continues to evolve.

Subscribe to our health benefits blog and follow us on social media to receive all our health benefits industry insights.

"*" indicates required fields