Stay connected

Subscribe to our Inside WEX blog and follow us on social media for the insider view on everything WEX, from payments innovation to what it means to be a WEXer.

A digital wallet is an application that runs on mobile devices and computers and allows users to make financial transactions through online channels. Individuals and companies can securely store payment information – including credit card, debit card, or bank account information – and passwords in their digital wallets, allowing them to pay without writing a paper check or pulling out a physical credit card.

It can be hard to make the transition from traditional paper checks, but a digital wallet is a more cost-effective, smarter way to make payments so it’s worth looking into a digital payments tool for your company.

All the expenses that come from writing, mailing and tracking paper checks are eliminated when a company begins using a digital wallet. These expenses include postage fees, the cost of tracking lost checks, and perhaps most importantly, administrative time and attention. Over the course of months and years, these costs add up to significant and unnecessary financial disadvantages. A product like WEX Select (formerly known as Flume), a digital wallet built for small businesses, can simplify the way your company makes payments, and in doing so can strengthen your company’s stability and improve your bottom line.

An accounts payable (AP) or accounts receivable (AR) department within a small business may consist of just a few employees, or even in some cases just one employee. These folks work very hard to keep all your finances in order. They’re doing a lot of their work manually and are constantly on the lookout for solutions to a variety of their accounting needs. What’s great about a digital wallet for your small business is that it will help you alleviate some of the pressure on your accounting staff by allowing one-stop shopping for all your business’s AP and AR needs. WEX Select (formerly known as Flume), for example, provides a singular solution to managing your finances. Many of the digital accounting technologies on the market are hodgepodge, separate AP and AR systems which are feature-bloated and effectively create problems by requiring a long and convoluted learning process. WEX Select (formerly known as Flume) offers one solution targeted to businesses just like yours.

Studies show that 80% of businesses still use paper checks for invoices. For the typical small-to-medium business (SMB) that issues 450 invoices per month at an estimated cost of $15 per invoice, it costs $80,000 a year just to manually process invoices. WEX Select (formerly known as Flume) alleviates these issues by offering a transparent, digital payments platform that eliminates the need for manual AP and AR processes.

WEX Select (formerly known as Flume) is a one-stop shop to manage the financial part of your business. Rather than having myriad ways to make payments with the digital wallets that have cropped up over the last decade, WEX Select (formerly known as Flume) provides businesses with a way to process all their payments – both AR and AP – on one platform. With WEX Select (formerly known as Flume) you can make any payment and you have a whole suite of options for putting through a transaction. Physical checks are still part of the equation, but only if you wish. You can start to move into digital payments using digital checks, ACH, and WEX Select (formerly known as Flume).

WEX Select (formerly known as Flume) is the one of the only digital wallets on the market that offers this full suite of products including the physical check which makes it the most suited to a small business looking for a way to transition from paper check to digital payments at its own pace. WEX Select (formerly known as Flume) also allows businesses and their suppliers to see every transaction between them, allowing for more transparency and more control.

If your suppliers are not yet ready to jump directly into digital payments, WEX Select (formerly known as Flume) allows you to still make payments by paper check. This works by way of a digital payment being emailed to your supplier in the form of a printable check. Your supplier receives this email payment from you, can print the email and bring that printable check to the bank to make their deposit. This way, information about every single payment your company makes is stored in one place electronically while also keeping your suppliers happy. Suppliers can also choose direct deposit and have those checks deposited automatically into their bank accounts which is another nice option. Through WEX Select (formerly known as Flume), users can also choose to send a physical check by mail and suppliers will receive that check within 3-5 days.

By sending a printable digital check you gain the benefits of swift insights into the status of that check. Instead of writing a physical check and putting it in the mail, with WEX Select (formerly known as Flume) you create that payment within the application, automatically generating a record of the payment, and creating the physical check in one fell swoop. Because this work is done in a digital payments tool, and within a single platform, all the data tied to that check is available to your business. You can see the status of that check as it is delivered, opened, and printed out. As opposed to the zero-visibility status once a physical check is sent via USPS, printable digital checks benefit both your small business and the vendor you’re paying.

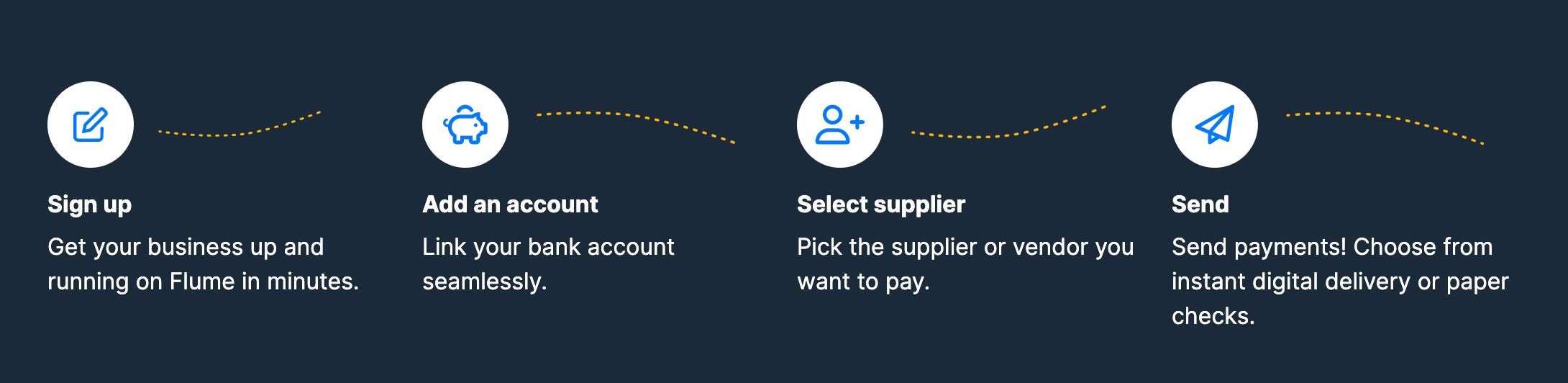

Signing up for a digital wallet is as easy as one, two, three, four! With WEX Select (formerly known as Flume), for example, all you need to do is sign up, add an account, select a supplier and send a payment! Before you know it, you can be making payments and getting paid digitally.

When you join WEX Select (formerly known as Flume), your company does not have to share its bank details. Instead, you will log into your bank within the WEX Select (formerly known as Flume) tool, bypassing unnecessary security risks. WEX uses a widely used and highly respected third-party platform called Plaid. Plaid provides the connection between WEX Select (formerly known as Flume) and your business’ bank account. As part of the onboarding process with WEX Select (formerly known as Flume) you’ll be asked how you want to pay and get paid – this loads a Plaid set of screens and from there you are able to log into your bank account. Plaid is FDIC approved, and their platform ensures the connection between WEX and your bank account is extremely secure, private, and safe.

You can also skip this step initially and take a look around the tool before deciding to join WEX Select (formerly known as Flume). You will be able to start making and receiving payments as soon as you connect your bank account.

WEX Select (formerly known as Flume) allows businesses to make and receive payments directly from account to account within WEX Select (formerly known as Flume) small business digital wallet program.

WEX cares most about simplifying your business processes. When we recognized that a lot of our small business customers weren’t finding a payments solution on the market specific to the size and complexity of their business we decided to do something about it. We went to our small business owners and spoke with them about what they needed and how we could help. Enter WEX Select (formerly known as Flume), a payments platform specifically designed to cater to niche small business owners like you. WEX Select (formerly known as Flume) is your answer for how to simplify your payments processes with an easy-to-use, intuitive tool specifically for businesses who might not already be doing a lot digitally.

To learn more about WEX, a growing and global organization, please visit wexinc.com.

Subscribe to our Inside WEX blog and follow us on social media for the insider view on everything WEX, from payments innovation to what it means to be a WEXer.