Stay connected

Subscribe to our health benefits blog and follow us on social media to receive all our health benefits industry insights.

Earlier today, the Internal Revenue Service issued a bulletin announcing 2020 health savings account (HSA) contribution limits will increase slightly, reflecting an adjustment for inflation.

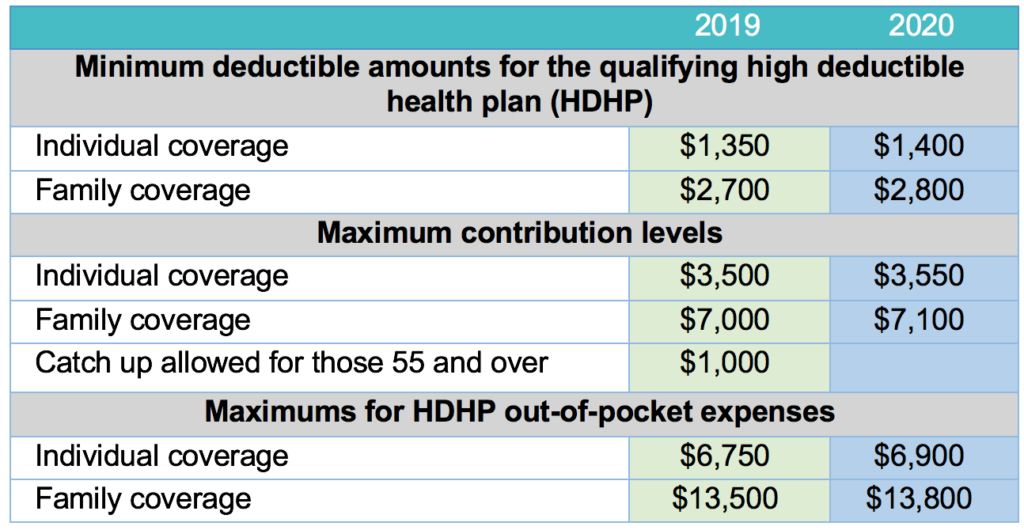

For 2020, the HSA contribution limits are $3,550 for individuals with self-only coverage under a high-deductible health plan (HDHP), a $50 increase from 2019. For family coverage, the contribution limit is $7,100, a $100 increase from 2019.

Increased deductible amounts and expense limits were also announced for HDHPs: In 2020, an HDHP will be defined as a health plan with an annual deductible that is not less than $1,400 for self-only coverage or $2,800 for family coverage, and the annual out-of-pocket expenses (deductibles, co-payments and other amounts, but not premiums) must not exceed $6,900 for self-only coverage or $13,800 for family coverage.

Learn more about HSAs on our Health Trends & Insights blog and by downloading our new consumer research report, “Paying for Healthcare in America.”

Subscribe to our health benefits blog and follow us on social media to receive all our health benefits industry insights.