Stay connected

Subscribe to our Inside WEX blog and follow us on social media for the insider view on everything WEX, from payments innovation to what it means to be a WEXer.

Lifestyle spending accounts (LSAs) offer you a way to provide a personalized and flexible benefit to support employees’ mental, physical, and financial wellness needs. Furthermore, they are post-tax accounts, so employers can easily control how you want your LSA to be designed. But there are some LSA rules you need to follow to stay compliant. Keep reading to learn more about LSA compliance and how to design an LSA plan at your company.

As the employer, you determine employee eligibility. Many companies offer LSAs as part of their employee benefits package, aiming to support overall employee wellness and satisfaction. Some companies may offer LSAs to all employees, while others might tailor eligibility based on job roles or seniority levels. Regardless of the eligibility specifics you choose, LSAs serve as a valuable benefits perk that supports employee engagement and contributes to a positive workplace culture.

There are no set employer contribution rules for LSAs, so you can decide how you would like to fund your employees’ LSAs. But remember, your financial commitment to LSAs reflects a commitment to supporting your employees’ diverse lifestyle needs. We recommend providing your employees with LSA funds in a consistent manner, such as employees receiving the same amount at the beginning of the plan year.

The most popular contribution schedules for employers with a WEX LSA are:

Since LSAs are employer-funded, employees do not make contributions to these accounts. Instead, it’s the employer’s responsibility to contribute to an eligible employee’s LSA.

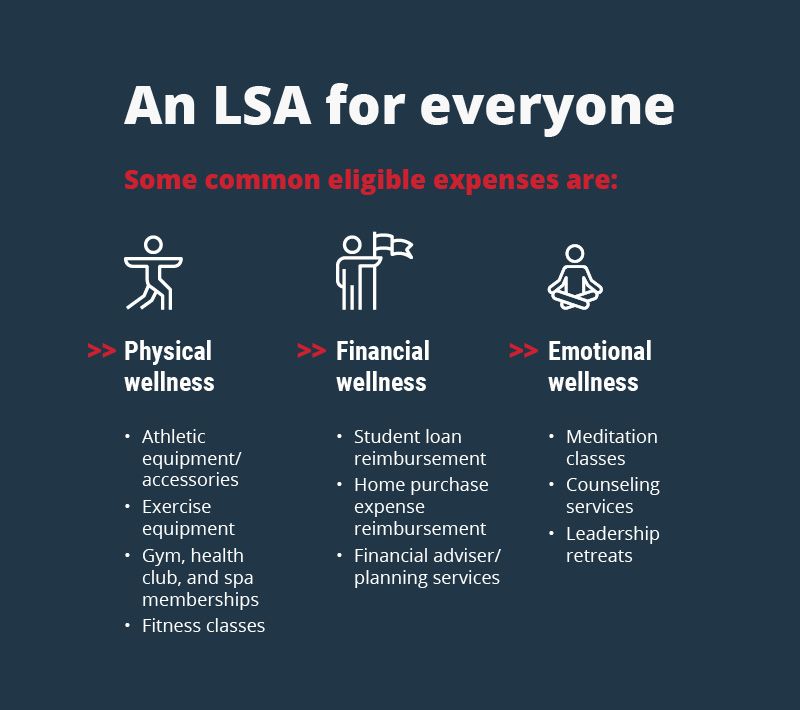

Eligible expenses for LSAs can include a wide range of wellness categories and are completely customizable by the employer. Commonly, LSAs cover expenses related to mental, physical, and emotional wellness, including athletic equipment, financial advisor/planning services, counseling services, and more. But to avoid triggering group health plan laws, exclude 213(d) medical expenses from your LSA. The key to an ideal LSA plan is to offer eligible expenses that meet the unique wellness needs of your employees without causing any additional reimbursement headaches for you or your employees.

When designing an LSA, prioritize flexibility and customization and decide what your main goals are for your LSA. Is it recruitment and retention? Or better utilization of benefits? Start by conducting surveys or engaging in conversations to understand the unique lifestyle preferences of your workforce.

Clearly define eligible expense categories and create a communication strategy to educate your employees on LSA details, contribution times, and eligible expenses. Regularly review and update your LSA based on employee feedback and evolving lifestyle trends. A well-designed LSA not only supports employee wellness, but also contributes to a positive workplace culture and employee satisfaction.

Learn more about LSAs and other employee benefits by subscribing to our blog!

The information in this blog post is for educational purposes only. It is not legal or tax advice. For legal or tax advice, you should consult your own legal counsel, tax and investment advisers.

WEX receives compensation from some of the merchants identified in its blog posts. By linking to these products, WEX is not endorsing these products.

Subscribe to our Inside WEX blog and follow us on social media for the insider view on everything WEX, from payments innovation to what it means to be a WEXer.