Stay connected

Subscribe to our Inside WEX blog and follow us on social media for the insider view on everything WEX, from payments innovation to what it means to be a WEXer.

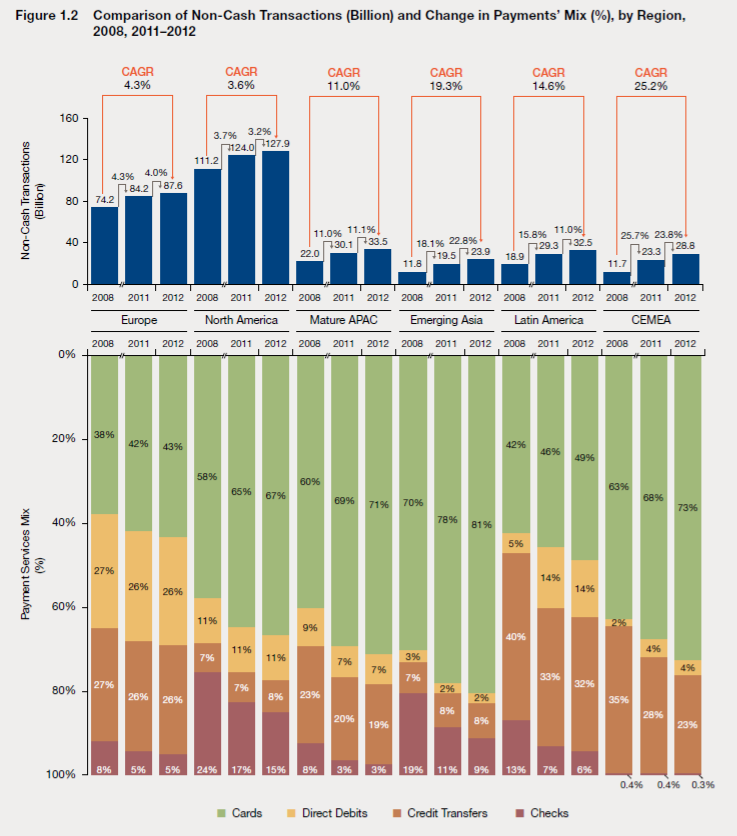

As the world becomes more connected, emerging markets develop a middle class, and technology allows for an increase in global and cross border ecommerce, there comes an increasing industry for non-cash payments.

According to the 10th Anniversary Edition of the World Payments Report, globally, non-cash transactions were estimated to reach 365.6 billion transactions, driven by a 20.2% increase in developing markets.

These developing markets—Asia; Central America; and Central Europe Middle East, and Africa (CEMEA)—led the way in percentage of growth, but how did the numbers stack up?

As paper checks begin to lose their luster, contracting 9.6%, debit and credit card transactions are on the rise: debit card transactions grew by 13.4% during 2012 to 140.8 billion and credit card transactions rose 9.9%, reaching 62.7 billion transactions.

Another winner in non-cash transactions, direct debit, recognized higher adoption, due in part to an improved economy, in which individuals felt more comfortable scheduling payments.

Looking toward the future, the following three trends are disrupting, or set to disrupt, the non-cash industry:

As we move into a more connected society, the technologies that control payments will continue to shift and emerging markets will continue to adopt non-cash payments. As this happens, the globalization of payments will result in a demand for the simplification of cross-border payments to match the speed in which transactions take place. We look forward to sharing our take on the upcoming 2015 report, scheduled for October 2015.

Source: World Payments Report 2014

Subscribe to our Inside WEX blog and follow us on social media for the insider view on everything WEX, from payments innovation to what it means to be a WEXer.