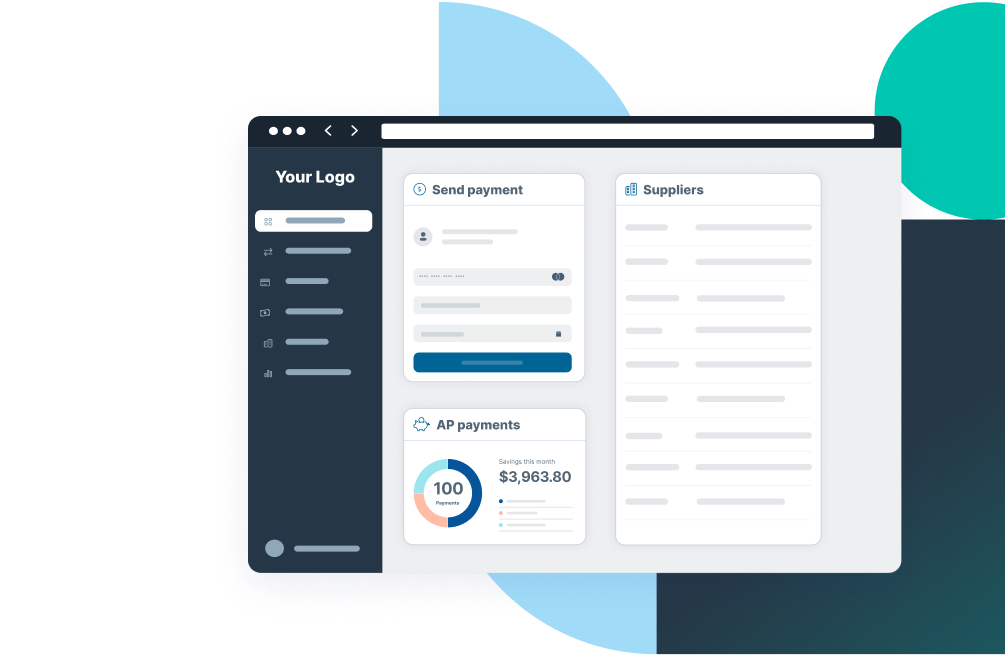

A modern payment processing platform for your customers

WEX’s back-end platform integrates with your branded solution to optimize your customers’ payments processes so you can focus on innovation and growing your business.

End-to-end payments for your customers

Seamless and scalable integration

In the fast-paced world of payments, WEX has stayed ahead of the curve as a pioneer of virtual card payments and with our modular payment processing technology. With WEX, you can offer a multi-modal payments processing and reconciliation solution to your customers.

- Flexible pay-and-get-paid solutions that meet your customers’ needs

- Customizable processing stack, to support multiple payment types and delivery options

- Fast, modular integrations with your customer systems

- An ever-expanding set of more than a million suppliers already accepting WEX virtual cards

- Experienced in navigating regional and global regulatory environments

Scale, stability and reach

$0B+

in payments in 2024

0+

currencies supported worldwide

0+

engineers dedicated to payments innovation

Simplify your payments with the WEX payment platform

Rely on our platform to manage everything from accounts payable to issuing to transaction processing.

Payment Management

Payment issuing

Payment processor

Payment Delivery

Transform your business with increased efficiency and revenue

Let WEX payments solutions work for your business

Stay connected

Subscribe to our Corporate Payments Edge newsletter and follow us on social media to keep up with the latest payments innovations.