Global payments solutions for the travel industry

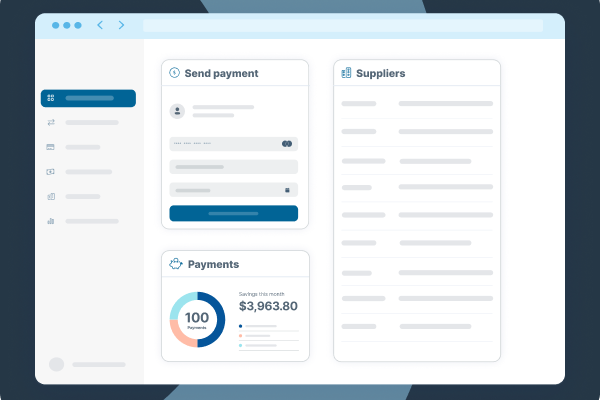

Efficiently and securely pay travel suppliers anywhere in the world with the flexible travel payments platform from WEX.

Trusted by

Simplify travel payments with WEX virtual card numbers

Travel is a dynamic industry and requires a flexible, customizable, secure B2B payments solution. Online travel agencies (OTAs) and travel intermediaries need payment optionality and flexible funding choices that let you pay suppliers the way they prefer to be paid—without any extra work.

WEX virtual card numbers (VCNs) help OTAs automate reconciliation, minimize counterparty risk, reduce fraud, and deliver better payments outcomes across the value chain.

- Provide safer payments with single-use, 16-digit card number generated for supplier payment

- Reduce your risk of fraud and access better protection from supplier failure

- Achieve lower cost (and lower bank fees) and faster reconciliation

- Act as the merchant of record, simplifying payments and earning more direct revenue and rebates

- Automate highly manual processes and reconciliations

Create a one-stop shop for B2B payments

When busy travel seasons hit, it’s critical that your payment processes can scale alongside increased volume.

Our payment technologies allow you to connect disjointed payments and data exchanges through personalized technology solutions and resources, helping you streamline payments and reach more customers by offering more supplier opportunities.

Go further with travel payments

*Internal WEX analysis

Everything travel intermediaries need to win in rapidly changing markets

Power your global success with industry-leading products

Stay connected

Subscribe to our Travel Payments Insights blog and follow us on social media to receive all our travel industry insights.