Stay connected

Subscribe to our health benefits blog and follow us on social media to receive all our health benefits industry insights.

Funded HRAs with a VEBA trust (sometimes just referred to as a “VEBA”) are another type of benefit that allows employers to support employees’ long-term healthcare needs. The tax law for VEBAs has been around for nearly 100 years, but VEBA usage and popularity has evolved over time as additional benefits, such as health savings accounts (HSAs) have been introduced.

Check out my appearance on Benefits Buzz or keep reading to learn more!

VEBA stands for voluntary employees’ beneficiary association. VEBAs are employer-funded, tax-free irrevocable trust arrangements that are often paired with HRAs. Because of this, the term “VEBA” often refers to the VEBA-funded HRA.

IRS Section 501(c) (9) governs VEBAs and describes them as “an organization organized to pay life, sick, accident, or similar benefits to members or their dependents, or designated beneficiaries.”

They are primarily offered within the public sector (such as school districts) and by unions. For these organizations that support retiree medical needs, VEBAs reduce liability because a trust is used. That’s why you typically see VEBAs in these industries.

The IRS states that they can only be offered by organizations that meet the following requirements:

Employees must be covered by an employer-sponsored health plan to be eligible for a VEBA-funded HRA.

Employers contribute 100 percent of the funds.

They can be used to pay for 213(d) eligible expenses and medicare premiums in retirement. The employer determines eligible expenses and if enrollees can spend their funds on eligible medical expenses while actively employed.

WEX makes it easy to spend VEBA-funded HRA dollars by providing one mobile app and one WEX benefits card for all of their WEX benefits.

Yes! The ability to invest VEBA-funded HRA dollars is similar to what you’d find with an HSA. And any VEBA earnings through investment accumulate tax-free. Like HSAs, VEBAs also have the triple-tax advantage of tax-free:

Yes, the two accounts are compatible when the VEBA is limited to dental and vision expenses. When the participant meets their deductible, then the VEBA can cover qualified medical expenses.

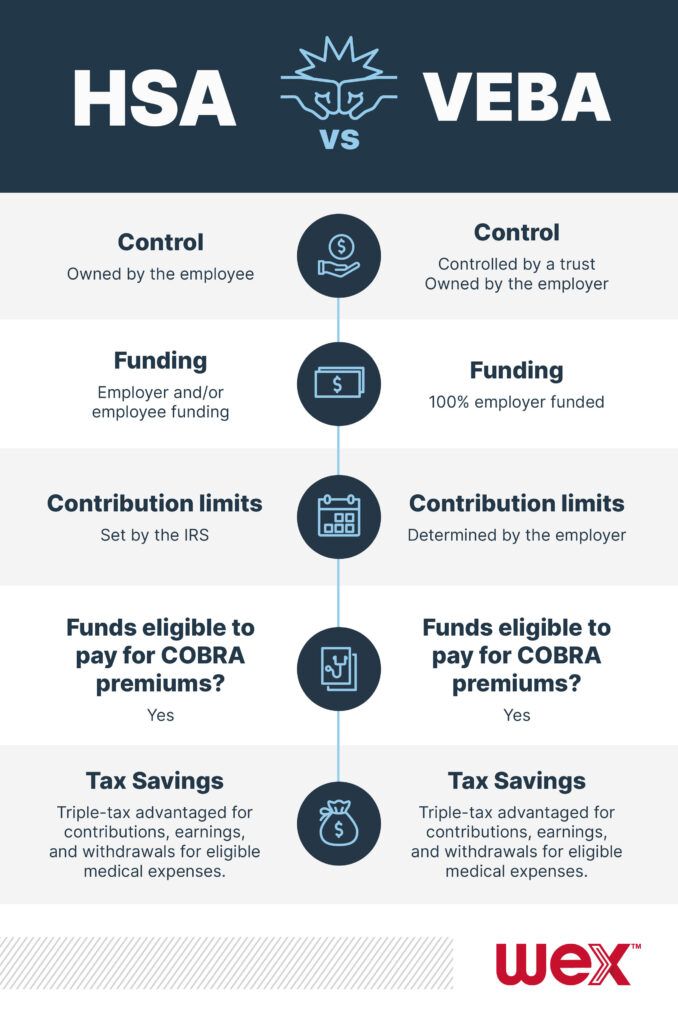

Would you like to learn more about how VEBAs compare with HSAs? Check out our graphic below and learn more about benefits accounts with WEX!

David Ritchie of BPAS contributed to this blog post.

The information in this blog post is for educational purposes only. It is not legal or tax advice. For legal or tax advice, you should consult your own counsel.

WEX receives compensation from some of the merchants identified in its blog posts. By linking to these products, WEX is not endorsing these products.

Subscribe to our health benefits blog and follow us on social media to receive all our health benefits industry insights.