Stay connected

Subscribe to our Inside WEX blog and follow us on social media for the insider view on everything WEX, from payments innovation to what it means to be a WEXer.

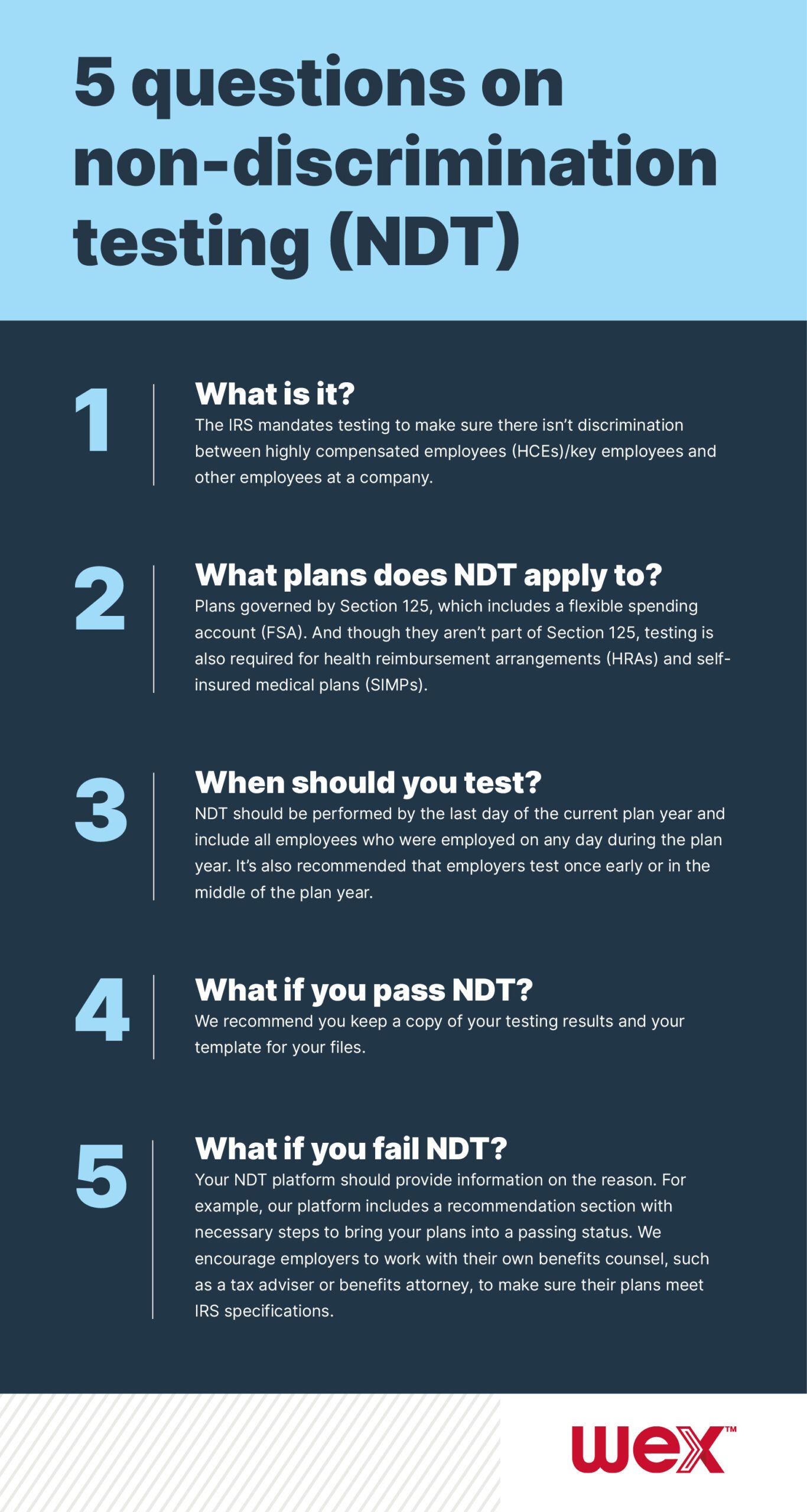

If you’re an employer, performing non-discrimination testing (NDT) is important when it comes to offering benefits to your employees. And proving compliance is something the IRS doesn’t just suggest, but requires.

Non-discrimination testing rules were created by the IRS and are generally designed to prevent plans from discriminating in favor of individuals who are either highly compensated or otherwise key to the business. Testing shows whether or not your tax-advantaged plans are discriminating in favor of highly compensated employees or key employees.

The IRS requires non-discrimination testing for employers who offer plans governed by Section 125, which includes a flexible spending account (FSA). And though they aren’t part of Section 125, testing is also required for health reimbursement arrangements (HRAs) and self-insured medical plans (SIMPs).

The IRS mandates testing to make sure there isn’t discrimination between highly compensated employees (HCEs)/key employees and other employees at a company. To meet IRS requirements, the test results need to demonstrate fairness in benefit plans among all levels of employees at a business. Failure to comply puts employers and their employees at risk of having to pay taxes on the benefits and IRS penalties.

NDT should be performed by the last day of the current plan year and include all employees who were employed on any day during the plan year. It’s also recommended that employers test once early or in the middle of the plan year. This mid-year testing helps determine if additional steps should be taken to ensure the employer passes the test by the end of the plan year.

Anyone you choose to give access to your payroll information can complete the template. You should consider that an individual must be given the role of “compliance” within our system to be able to access our testing software.

Our NDT clients have access to six testing options that cover five types of plans. They’re encouraged to review their testing guide to ensure they’re completing the appropriate template based on the plans offered.

Depending on their needs, there are a number of specific tests available. But all of them share three central criteria that are a focus of the test. A benefits plan will be considered discriminatory and fail to be in compliance if:

Not enough non-HCEs are eligible for a plan.

The HCEs or key employees are able to get more benefits than other employees.

The HCEs or key employees take more benefits under the plan than other employees.

Below is a breakdown of the tests for each of the five plans that WEX provides non-discrimination testing for:

| Plans | Tests available for each | |||

| Cafeteria plan | 25% Key Employee Concentration Test | Eligibility Test | Contributions and Benefits Test | Subjective Questions |

| Medical FSA | Health FSA Eligibility Test | Subjective Questions | ||

| Dependent care FSA | More than 5% Owners Concentration Test | 55% Average Benefits | Eligibility Test | Subjective Questions |

| HRA | HRA Eligibility Test | Subjective Questions | ||

| SIMP | SIMP Eligibility Test | Subjective Questions | ||

A few of the tests for medical FSA non-discrimination testing are:

A medical FSA cannot discriminate in favor of HCIs as to eligibility to participate. A medical FSA that satisfies any one of the three tests will pass the Health FSA Eligibility Test.

If you’re using NDT with WEX, we suggest applying the third test, Safe Harbor Percentage test (Post-TRA Nondiscriminatory Classification Test), first. Given the low participation rates for medical FSAs, the 70% and 70%/80% Tests will seldom be satisfied.

Unfortunately, some businesses fail to complete non-discrimination testing, either because their third-party administrator doesn’t provide the testing or because the system provided is too complicated.

That’s not the case with WEX. Our non-discrimination testing tool allows a compliance contact within our client’s company to easily complete the tests directly from their LEAP, which is our easy-to-use employer portal.

Our NDT clients can perform non-discrimination testing of FSAs, HRAs, Self-Insured Medical Plans (SIMPs) and more for just one flat rate throughout the plan year. You’ll be able to:

Access immediate results through downloadable, online reports.

Easily obtain historical reports for past tests.

Bundle non-discrimination testing with your administration so all of your needs are in one place.

Learn more about our non-discrimination testing solution in this video:

Testing can be completed and you can get results in a matter of minutes once you upload the completed template.

If the Results report advises you of a failed result, the recommendation section found at the end of the Results report will provide necessary steps to bring your plans into a passing status. We encourage employers to work with their own benefits counsel, such as a tax adviser or benefits attorney, to make sure their plans meet IRS specifications.

We do recommend that you keep a copy of your testing results and your template for your files.

Listen to our Benefits Buzz podcast episode or check out our infographic below to learn more about NDT.

Subscribe to our Inside WEX blog and follow us on social media for the insider view on everything WEX, from payments innovation to what it means to be a WEXer.