Stay connected

Subscribe to our Inside WEX blog and follow us on social media for the insider view on everything WEX, from payments innovation to what it means to be a WEXer.

Save 25¢ per gallon for 3 months§ with the WEX Fleet Card. Hurry, offer ends TODAY. Learn more

A flexible spending account (FSA) allows participants to save money by setting aside pre-tax dollars to pay for eligible medical, dental, vision and dependent care expenses incurred by you, your spouse, or your eligible dependents.

Whether you’re a newcomer to the account or have routinely participated in this benefits staple, we’ve compiled answers to some common questions to help you better understand your FSA. Or check out this episode of Benefits to learn eight things you should know about medical FSAs.

A FSA is an account that allows you to set aside pre-tax funds to pay out-of-pocket healthcare costs. FSAs are an employer-owned account, and the IRS sets limits on annual FSA contributions. Employers can provide either a grace period to use the money within the plan year, or a carryover of up to $660 from the plan year.

There are four common types of accounts:

In open enrollment, if your employer offers an FSA that you want to enroll in, you can determine a contribution amount up to the IRS contribution limit. Your employer can contribute to the FSA, but is not required to. The money you’ve elected to contribute will be deducted from your paycheck before taxes are deducted and placed into the FSA.

You can enroll in a FSA in many different ways. Open enrollment season is always an option, at the time of your hire, or if you experience a qualifying event, such as becoming married. You can also change your election amount during these status changes.

There are so many eligible expenses available! A general-purpose medical FSA covers many eligible expenses, such as:

A limited medical FSA covers eligible dental, vision, and preventative care expenses.

Dependent care FSA eligible expenses include:

Visit our searchable list to see all kinds of expenses that are eligible.

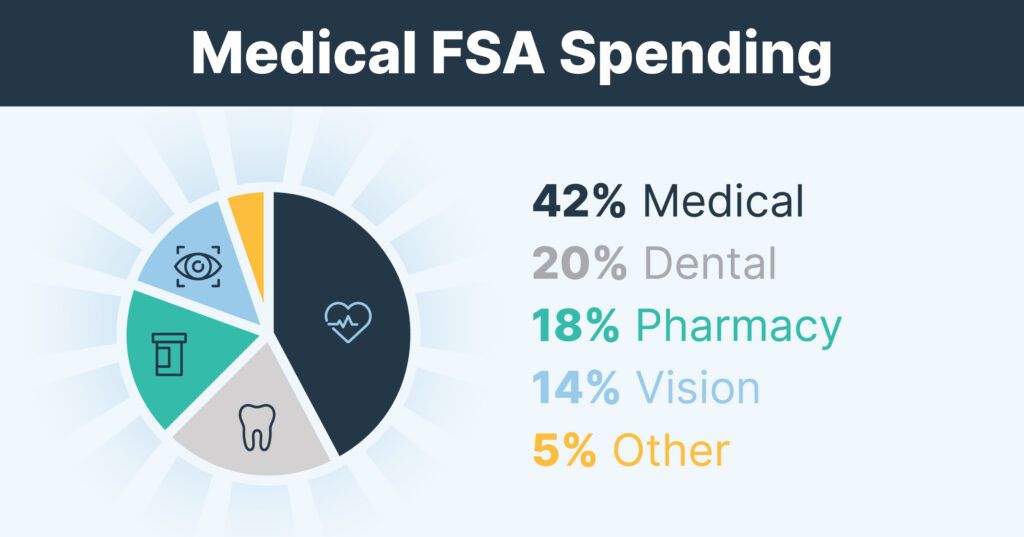

On the WEX benefits platform, here are the common expense categories for medical FSA purchase. For more benefit trends, click below!

You can submit a claim by using a benefits card (if you were provided one for your FSA) or paying out of pocket. FSA claims do need to be substantiated, which means you must provide documentation that has the IRS-required information to prove your purchase was eligible for FSA funds.

A benefits card can simplify claim filing; on average, participants using a WEX benefits card see 85% of their benefits card purchases automatically approved without the need for additional documentation.

Check out this blog post to learn more about what documentation should include and to find out more about the claim-filing process.

The IRS has a use-it-or-lose-it rule. For FSAs, this means that the funds at the end of the plan year must be spent unless your employer offers a grace period or carryover. This rule applies to both medical and dependent care FSAs.

For out-of-pocket expenses and some benefits card purchases, the IRS requires more documentation to validate that purchases were for eligible items or services. The IRS requires that documentation that includes:

An Explanation of Benefits (EOB) typically contains the information the IRS requires. If an EOB isn’t available, you can also submit an itemized receipt as long as it has the necessary information.

Would you like to learn more about how employers and employees save money through FICA taxes with an FSA? Check out our infographic below.

This blog post was most recently updated in May 2025.

The information in this blog post is for educational purposes only. It is not legal or tax advice. For legal or tax advice, you should consult your own legal counsel, tax and investment advisers.

WEX receives compensation from some of the merchants identified in its blog posts. By linking to these products, WEX is not endorsing these products.

Subscribe to our Inside WEX blog and follow us on social media for the insider view on everything WEX, from payments innovation to what it means to be a WEXer.