Stay connected

Subscribe to our Inside WEX blog and follow us on social media for the insider view on everything WEX, from payments innovation to what it means to be a WEXer.

The short answer: As much as you’re able to (within IRS contribution limits), if that’s financially viable.

If you’re covered by an HSA-eligible health plan (or high-deductible health plan), the IRS allows you to put as much as $4,300 per year (in 2025) into your health savings account (HSA). If you’re contributing to an HSA, and on a family HDHP, the maximum amount that you can contribute is $8,550 per year (in 2025). And for those who are 55 or older, you can contribute an extra $1,000 annually for a total of $5,300 or $9,550 for accountholders on a family plan — with catch-up contributions accepted at any time during the year in which you turn 55.

A health savings account gives you greater control of your healthcare expenses and potential savings. It also provides an avenue for you to build a nest egg for retirement and invest. With an HSA, you experience a triple-tax advantage:

Accountholders can truly maximize the potential of an HSA by tapping into its investment capabilities.

An HSA contribution is the deposit of funds (for example, from a bank account or your paycheck) into your HSA. HSA participants are advised to contribute the maximum amount each year because the dollars going into these accounts are tax-free. All HSA funds carry over from year to year, and your HSA stays with you even when you change jobs. This ensures accountholders are able to save long term for future medical expenses.

According to Devenir’s 2023 year-end HSA research report, HSAs saw record-breaking asset growth in 2023. By the end of the year, $123 billion in HSA assets were held in over 37 million accounts, showing a 19% year-over-year increase for assets and a 5% increase for accounts.

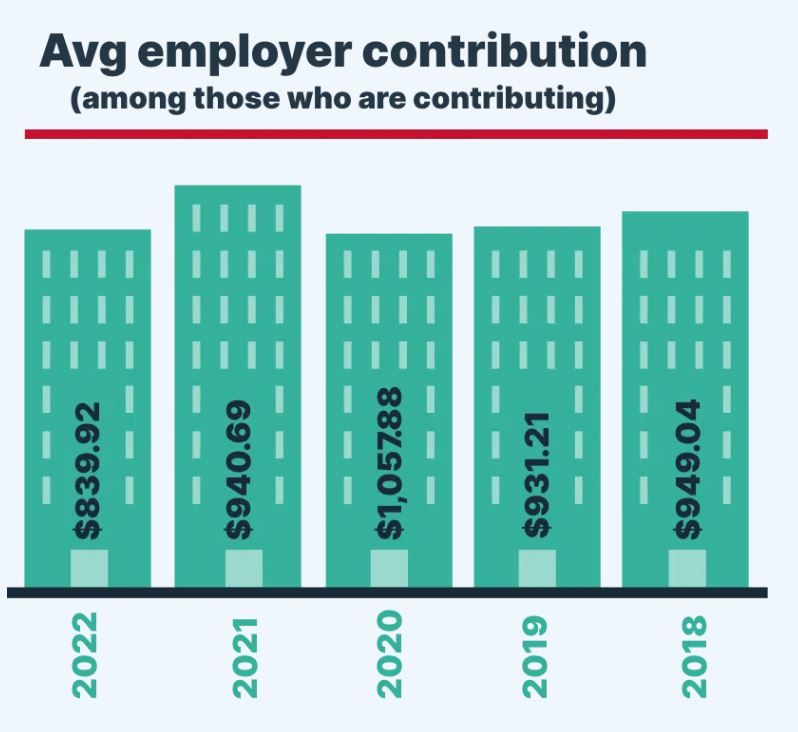

According to data on the WEX benefits platform, here are the year-by-year average employer contributions to an HSA. Get more benefit trends by clicking below!

You can use your HSA funds to pay for a variety of eligible medical expenses, including cold medicine, eye drops, copays, and eligible vision/dental care. By purchasing eligible expenses, your funds are not subject to taxes when you withdraw them from your HSA.

If you purchase ineligible expenses, withdrawal of your funds is taxable, and the funds are subject to an additional 20% tax penalty. If you have an HSA with WEX, you can use the eligible expense scanner on your benefits mobile app to scan the bar code of purchase so you know if they’re eligible for your HSA funds.

One oft-cited estimate: A 65-year-old couple retiring in 2020 will need an average of $351,000 in healthcare costs throughout retirement. If you’re uncomfortable contributing the IRS annual max to your HSA through pre-tax payroll contributions, contribute what you are comfortable with.

An HSA also provides the ability to contribute post-tax dollars and take an above-the-line deduction, essentially reducing taxable income for every post-tax dollar that’s contributed to the HSA. Additionally, accountholders have up until the tax filing of the following year to make these post-tax contributions for the previous year.

At first glance, contributing the IRS-allowed maximum to your HSA in one year may sound unimaginable. But when taking into account the premium savings of a HDHP, compared to a traditional health plan, plus tax savings gained through contributing to an HSA, it becomes more realistic.

Need help determining how much you should set aside in your HSA each month? WEX provides a My HSA Planner tool that will help you determine the right amount for you. It takes into account your health plan coverage type, deductible amount, number of years before retirement, monthly healthcare expenses and more.

Watch our below Benefits podcast episode to learn more about the basics of an HSA!

Editor’s note: This post was first published in January 2018. It was most recently updated in March 2025.

The information in this blog post is for educational purposes only. It is not legal, financial, or tax advice. For legal, financial, or tax advice, you should consult your own legal counsel, tax and investment advisers.

WEX receives compensation from some of the merchants identified in its blog posts. By linking to these products, WEX is not endorsing these products.

Subscribe to our Inside WEX blog and follow us on social media for the insider view on everything WEX, from payments innovation to what it means to be a WEXer.