Stay connected

Subscribe to our Inside WEX blog and follow us on social media for the insider view on everything WEX, from payments innovation to what it means to be a WEXer.

Save 25¢ per gallon for 3 months§ with the WEX Fleet Card. Hurry, offer ends TODAY. Learn more

If you’re a small business owner, the qualified small employer health reimbursement arrangement (QSEHRA) might be the benefits plan you’re looking for. Offering a QSEHRA lets you deliver healthcare savings for your employees, which could pay off as a retention and recruitment tool as you grow your business.

A QSEHRA is a tax-advantaged benefits plan funded by the employer that employees can tap into to pay for eligible expenses. You and your employees both save money because your reimbursements of their expenses are tax-free.

Small businesses are considered the “United States’ economic engine.” They drive job growth and innovation. Their success is vital to all of us, so it’s important to understand the unique challenges that small businesses face.

Nearly a quarter of them say providing healthcare to their employees is their biggest concern. QSEHRAs were rolled out in 2017 as a benefits plan that was specifically designed to help small businesses meet their employees’ needs.

QSEHRA rules state that, in order to offer this plan to your employees, you must:

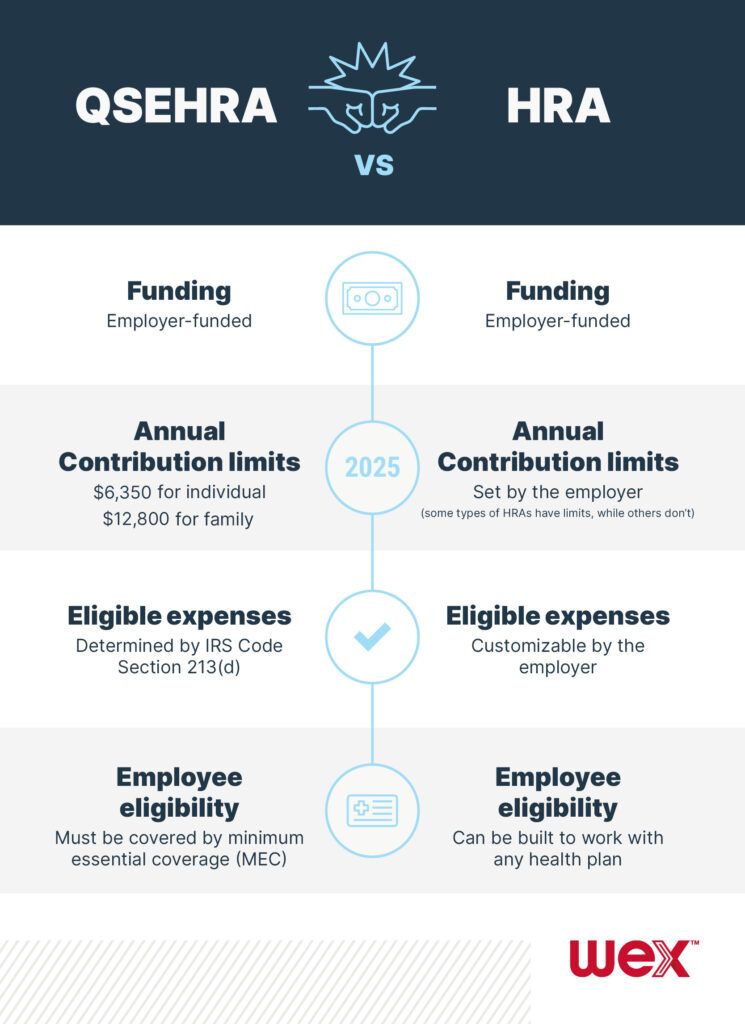

QSEHRA eligible expenses are determined by IRS Code Section 213(d) and, in the case of QSEHRAs, includes individual health insurance premiums paid by the employee.

There are 4 common types of HRA’s.

The big difference between a QSEHRA and the others is that a QSEHRA is available only for small businesses. This enables eligible businesses to take advantage of an affordable way to offer healthcare benefits to their workers. This also allows more flexibility in how employers can design their plan and the amount of money they can contribute towards an employees’ healthcare.

Another difference is that a QSEHRA is much more flexible than the other HRA’s. It does not require as many rules or regulations around the contributions and eligibility. A QSEHRA does not need to be integrated with an individual health insurance policy which makes it easier and more cost effective for small businesses to administer compared to the other HRA’s.

Integrated HRAs are sponsored by the employer and consist of a health plan provided to employees with a reimbursement of their medical expenses. These plans are often used to provide a more comprehensive benefit package to employees. Unlike a QSEHRA, they are more complex and require the employer to manage both health benefits and reimbursements for employees.

There are a few simple – but important – steps to follow when offering a QSEHRA. Make sure to determine:

The process varies based on the administrator, but generally, a few facts about the participant experience:

Would you like to learn more about HRAs with WEX? Check out our HRA product page.

The information in this blog post is for educational purposes only. It is not legal or tax advice. For legal or tax advice, you should consult your own counsel.

Subscribe to our Inside WEX blog and follow us on social media for the insider view on everything WEX, from payments innovation to what it means to be a WEXer.