Stay connected

Subscribe to our Inside WEX blog and follow us on social media for the insider view on everything WEX, from payments innovation to what it means to be a WEXer.

As pet owners, we consider our furry friends as cherished family members, providing them with love and care. Just like humans, pets can face unexpected health issues or accidents that may require veterinary attention. This is where pet benefits come into play.

Recently, we surveyed our participants. When asked what benefit they’d like to learn more about, pet insurance received the third-most responses. So your employees’ interest is piqued, too! Let’s explore the various types of pet benefits available and how they can benefit both you and your pet. And check out our Benefits podcast episode with Bridgit Moszer, regional sales director, direct sales at WEX and Jessica Shawn, senior manager, HR business partner at WEX, below.

Lifestyle spending accounts (LSAs) can be customized by you to cover your employees’ pet-related expenses. By incorporating pet-related expenses into LSAs, you are able to cover a range of pet care costs, including pet insurance premiums, veterinary visits, grooming, pet supplies, and more! This approach shows you care about your employees’ pets and helps alleviate financial burdens associated with pet ownership.

“Being able to differentiate yourselves as an employer by saying ‘Whatever is important to you (like your pets) is important to us too’ really helps employers to stand out,” said Moszer on our Benefits podcast. “There’s been a number of surveys that show benefit perks like pet benefits and lifestyle spending accounts play a major factor in job candidates deciding if they want to accept a job offer.”

Benefits:

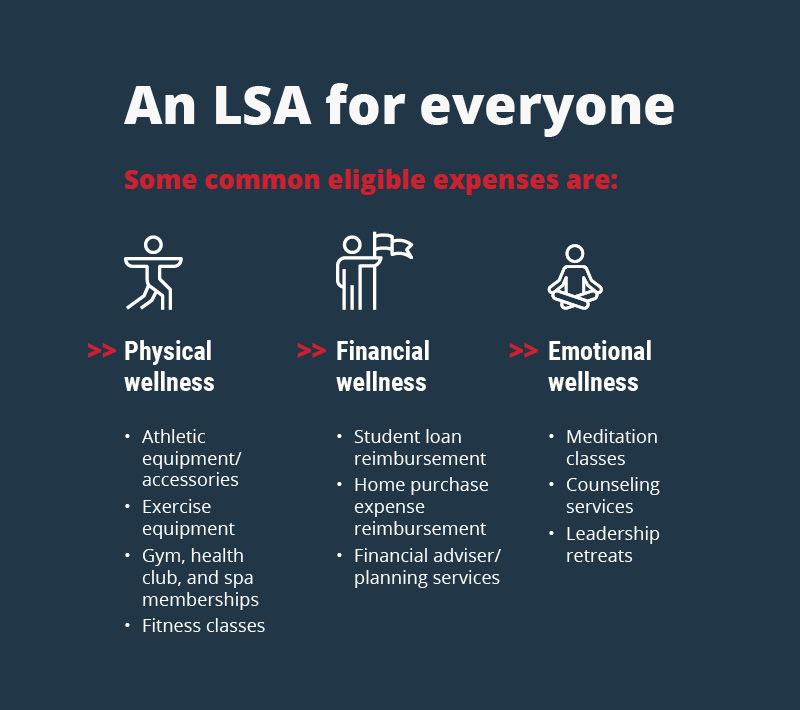

What else do LSAs commonly cover? Check out our graphic below. And keep reading to learn more about the types of coverage an LSA can provide or that you can provide through pet insurance.

Accident-only coverage is the most basic type of pet insurance and typically covers accidents and injuries resulting from unexpected events. This can include broken bones, cuts, sprains, and ingestion of foreign objects. Accident-only coverage does not typically cover illnesses or pre-existing conditions. While this type of coverage may not offer comprehensive protection, it can be an affordable option for pet owners who are primarily concerned about unexpected accidents.

Benefits:

Illness coverage is a more comprehensive form of pet insurance that not only covers accidents but also protects against a range of illnesses and diseases. This coverage includes veterinary visits, diagnostics, treatments, and medications related to covered illnesses. It is important to carefully review the policy to understand what specific illnesses are covered, as some policies may have exclusions or waiting periods for certain conditions.

Benefits:

While accident and illness coverage focus on unexpected events, wellness coverage aims to cover routine preventive care. This type of insurance typically includes vaccinations, annual check-ups, flea and tick prevention, dental cleanings, and other wellness-related services. Wellness coverage is usually offered as an add-on to an accident or illness policy, allowing pet owners to customize their coverage based on their pet’s specific needs.

Benefits:

Lifetime coverage, also known as lifetime or lifelong policies, offers continuous coverage throughout your pet’s lifetime, as long as the policy remains active and premiums are paid. These policies usually include both accident and illness coverage and provide financial protection for ongoing or chronic conditions, such as allergies, diabetes, or cancer. Lifetime coverage is particularly valuable for pets with breed-specific conditions or those prone to developing certain hereditary diseases.

Benefits:

Health savings accounts (HSAs) and flexible spending accounts (FSAs) may provide an additional avenue for covering the cost of a service dog. Service dogs play a crucial role in assisting individuals with disabilities and performing tasks that enhance their independence and quality of life. The cost of acquiring and training a service dog can be significant, but the good news is that HSAs and FSAs can potentially be used to cover these expenses.

By using HSAs and FSA funds, individuals with disabilities or diagnosed medical conditions that require a service dog for medical care can access the accounts to obtain and care for these invaluable companions. If you are considering a service dog, be sure to explore the possibilities of using your HSA or FSA as a resource for covering the associated costs.

Learn more about the benefits of a pet-friendly workplace.

The information in this blog post is for educational purposes only. It is not legal or tax advice. For legal or tax advice, you should consult your own legal counsel, tax and investment advisers.

WEX receives compensation from some of the merchants identified in its blog posts. By linking to these products, WEX is not endorsing these products.

Subscribe to our Inside WEX blog and follow us on social media for the insider view on everything WEX, from payments innovation to what it means to be a WEXer.