Stay connected

Subscribe to our Inside WEX blog and follow us on social media for the insider view on everything WEX, from payments innovation to what it means to be a WEXer.

"*" indicates required fields

Your health plan drives many of your decisions during open enrollment. One emerging trend is employers offering their employees health plan options. Nearly two-thirds of large employers provide their employees with the choice of a high-deductible health plan (HDHP) and a traditional health plan, such as a preferred provider organization (PPO), during open enrollment. Does your employer offer options? If so, let’s start by breaking down the two plans.

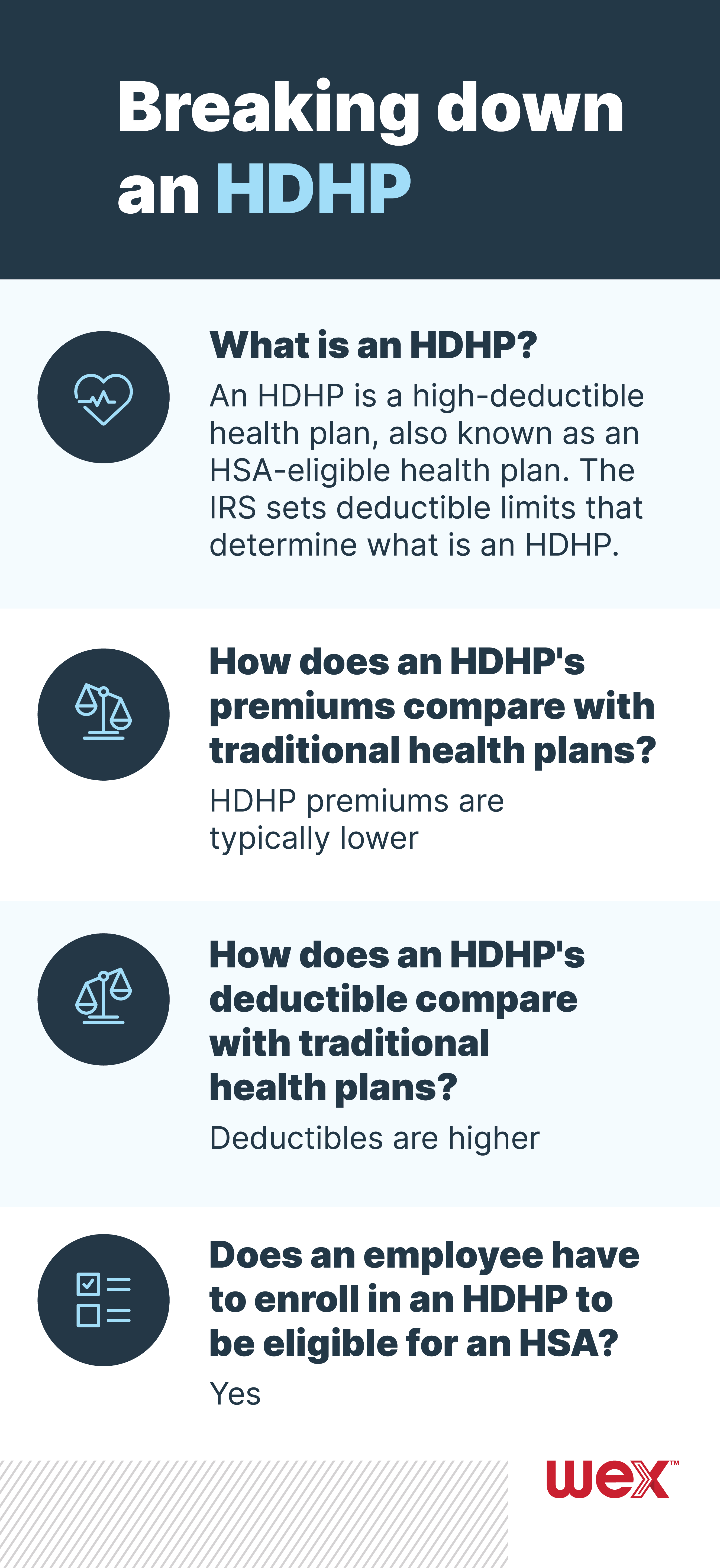

A high-deductible health plan, also known as an HSA-eligible health plan, has higher deductibles and typically lower premiums than a traditional health plan. The IRS sets deductible limits that determine what is an HDHP. You can find this year’s HDHP deductible and out-of-pocket limits here. You must be enrolled in an HDHP to be eligible to participate in a health savings account (HSA).

PPOs are a common type of traditional health plan. Healthcare.gov defines a PPO as “a type of health plan that contracts with medical providers, such as hospitals and doctors, to create a network of participating providers.” Costs are more manageable when you use providers that are in your plan’s network. Traditional plan PPOs typically have higher premiums and lower deductibles than HDHPs.

Yes. The term “HDHP” simply speaks to the deductible amounts within the health plan. An HDHP can be a PPO, although PPOs often have low deductibles (which we’ll refer to as a traditional PPO). But there are high-deductible PPOs, as well.

During open enrollment, you may see tables or charts that show your available plans’ premiums, deductibles, and/or out-of-pocket responsibility. Once you have those numbers, compare them with your family’s typical costs for expenses such as doctor visits and prescriptions. That’s a critical first step when weighing your choice of an HDHP versus a traditional PPO or another type of traditional health plan.

If you don’t anticipate you (or your family) will require a lot of medical care in the coming year, it may make sense to participate in an HDHP so you can save money by paying less in premiums. Use our HDHP/HSA Vs. Traditional Health Plan Calculator, which lets you input your annual doctor visit and prescription expenses to see the plan that’s right for you.

Premiums aren’t the only way you can save on healthcare costs. Pre-tax employee benefits plans, such as HSAs and flexible spending accounts (FSAs), let you save money by putting aside pre-tax dollars to pay for eligible medical, dental, vision and other expenses.

As mentioned above, you can participate in an HSA only if you are enrolled in an HDHP. And, if you have an HDHP and an HSA, you can pair both with a limited FSA (which covers dental, vision and preventive-care expenses) for even more savings! However, you can’t participate in an HSA and a full general-purpose medical FSA simultaneously.

Who isn’t interested in free money? Employers are able to contribute to their employees’ HSAs, some choose to contribute annually while others match their employees’ contributions. In 2023, the average employer contribution to employee HSAs was $929. WEX research has shown that employer contributions encourage employees to engage with their HSAs, which is a valuable partner to have when enrolled in an HDHP. For plan years that started in January 1, 2023, 87% of eligible employees on our benefits administration portal did participate in an HSA. These HSA contributions from an employer will help you cover the cost of a higher deductible when you do choose an HDHP versus a traditional PPO.

Healthcare costs are the biggest reason that household expenses increase during the first six years of retirement. The average 65-year-old couple is expected to need around $395,000 just for medical care in retirement. If you feel an HDHP is right for you, then an HSA can be part of your retirement-planning strategy for many reasons, including:

Are you comparing an HDHP versus a traditional PPO or other type of traditional health plan? Use our HDHP Vs. Traditional Health Plan Calculator today! Or watch our Benefits Buzz episode to learn more about HDHPs and common myths surrounding them.

This blog post was most recently updated in November 2024.

The information in this blog post is for educational purposes only. It is not legal or tax advice. For legal or tax advice, you should consult your own counsel.

Subscribe to our Inside WEX blog and follow us on social media for the insider view on everything WEX, from payments innovation to what it means to be a WEXer.

"*" indicates required fields